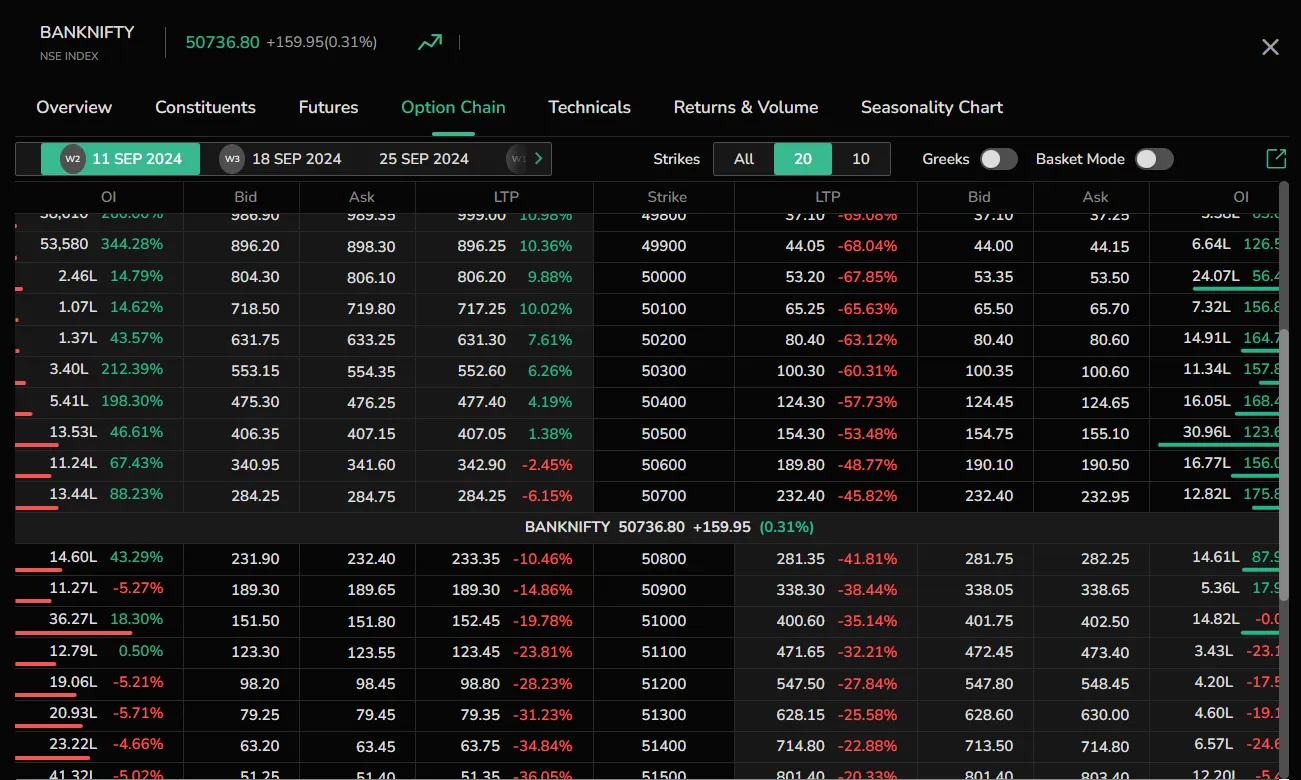

Option Chain

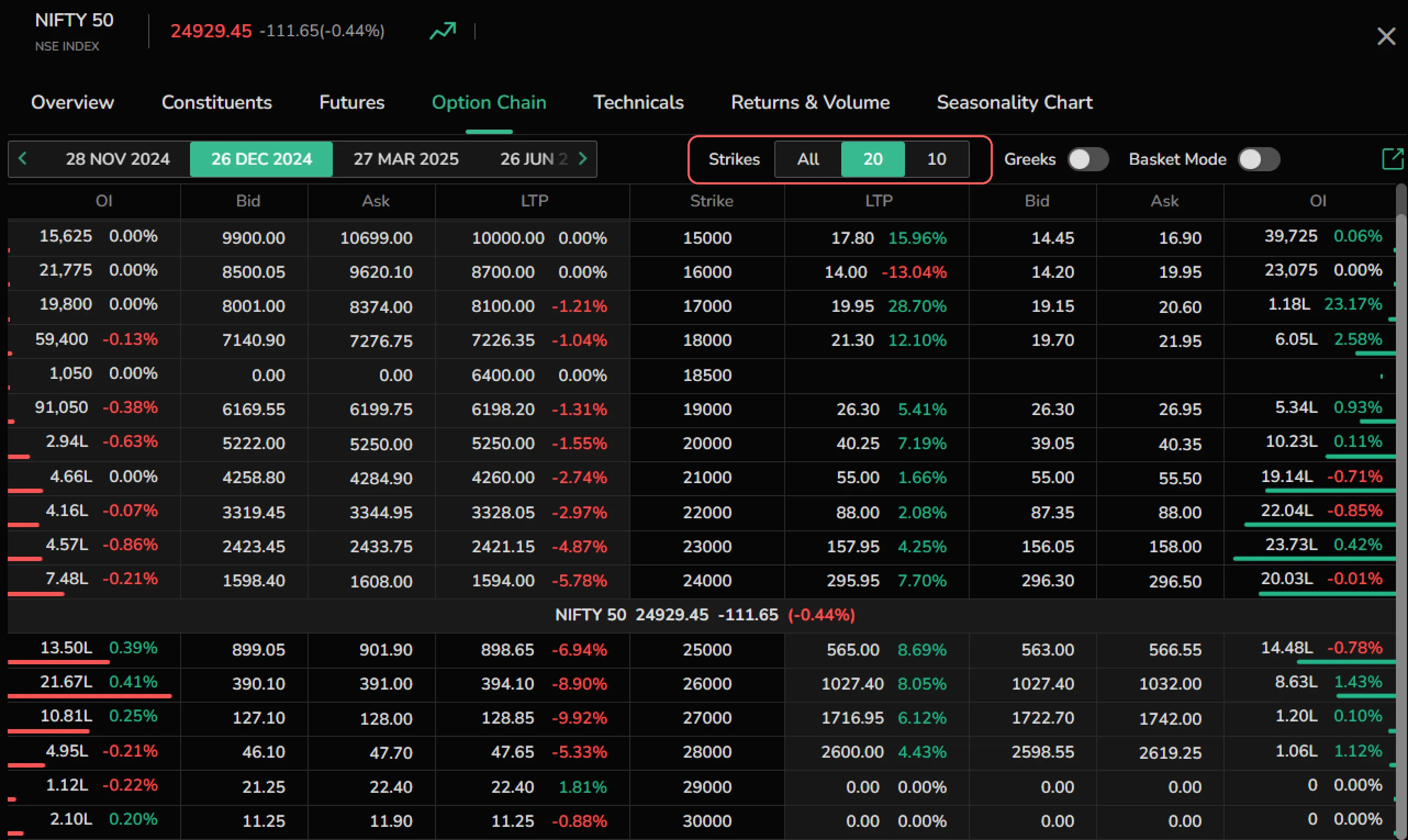

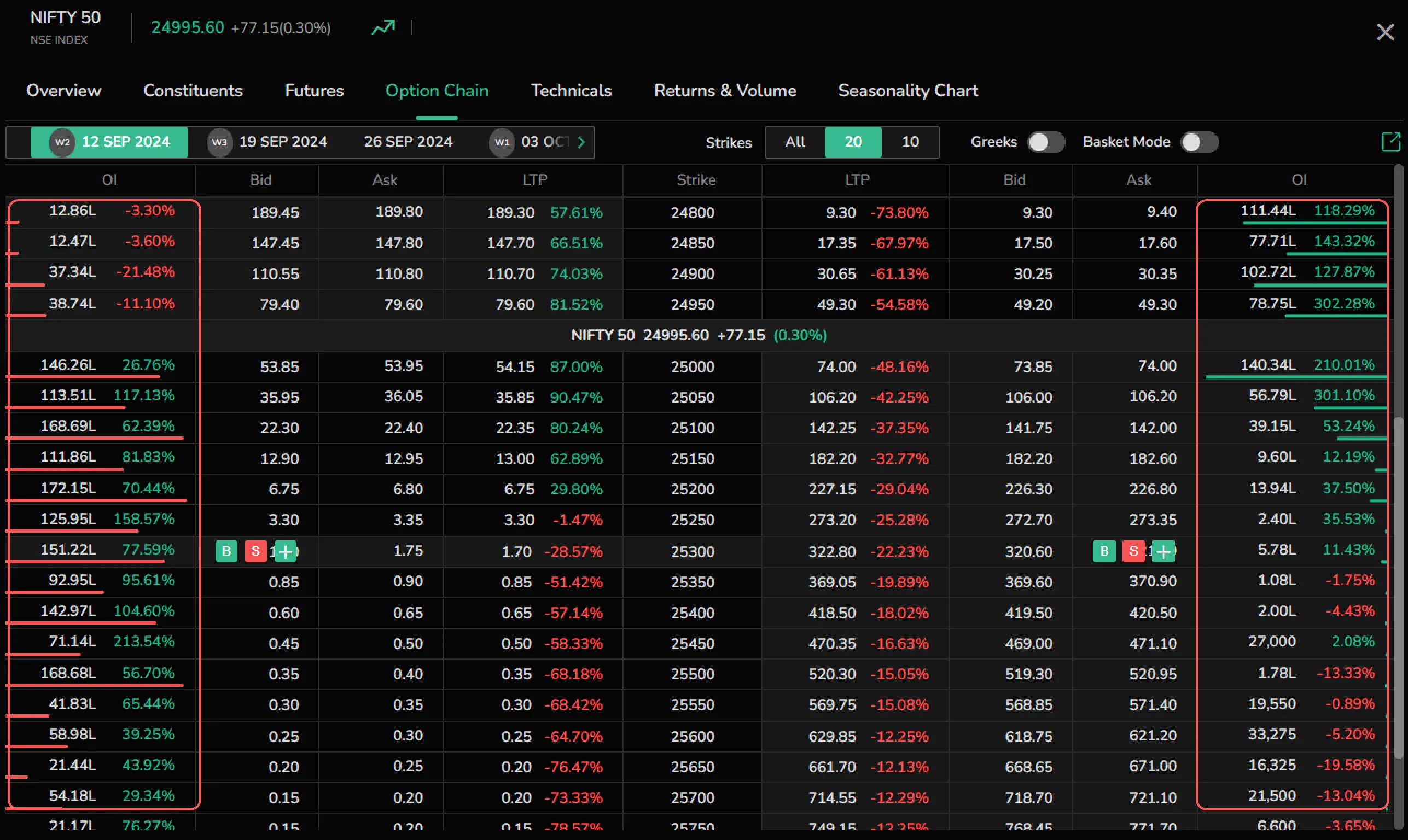

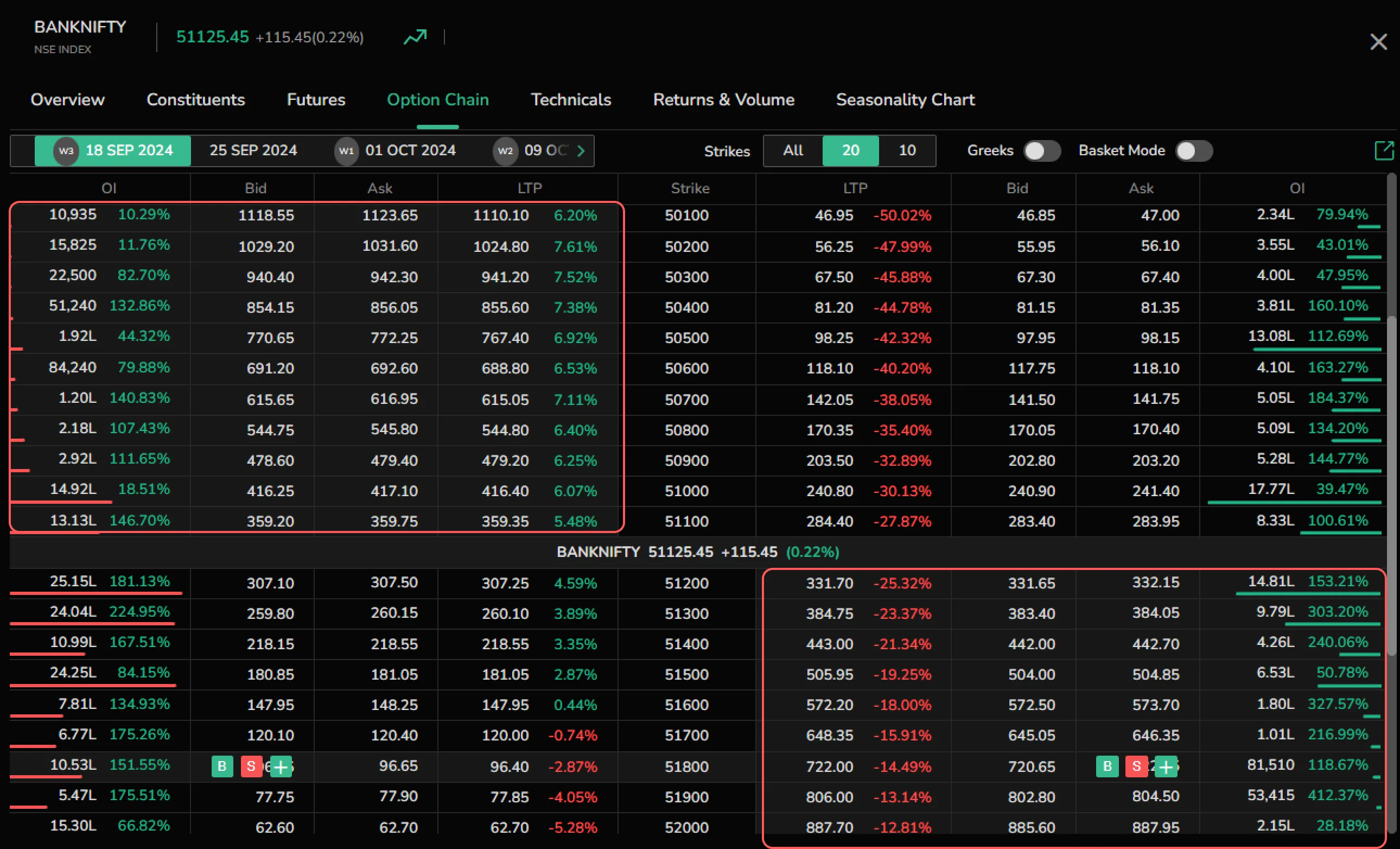

The Options Chain displays all available option contracts, including puts and calls, for the selected symbol and index. It provides detailed information on all puts, calls, strike prices, and pricing for the specific underlying asset.

Options can be classified as At the Money (ATM), In the Money (ITM), or Out of the Money (OTM), each crucial for investment decisions:

- ATM (At the Money): This option's strike price is equal to the current spot price of the underlying.

- ITM (In the Money): Options that presents a profit opportunity due to the intrinsic value.

- OTM (Out of the Money): Options where the current market price of the underlying is below the strike price for a call, or above the strike price for a put.

In the options chain, Spot price of the underlying is placed in the centre for convenience. Call options located above with strike price below spot are marked as ITM, while put options located below with strike price above spot are marked as ITM. The expiry date for each option can be selected from the top of the chain.

On the Web

Access Option Chain

- Via Watchlist: Click on ‘More Options’ next to a symbol in your Watchlist, then select ‘Option Chain’.

- Via Overview: Select the symbol name in your Watchlist, navigate to the Overview page, and access the Option Chain next to the Futures section.

Option Chain Functionalities

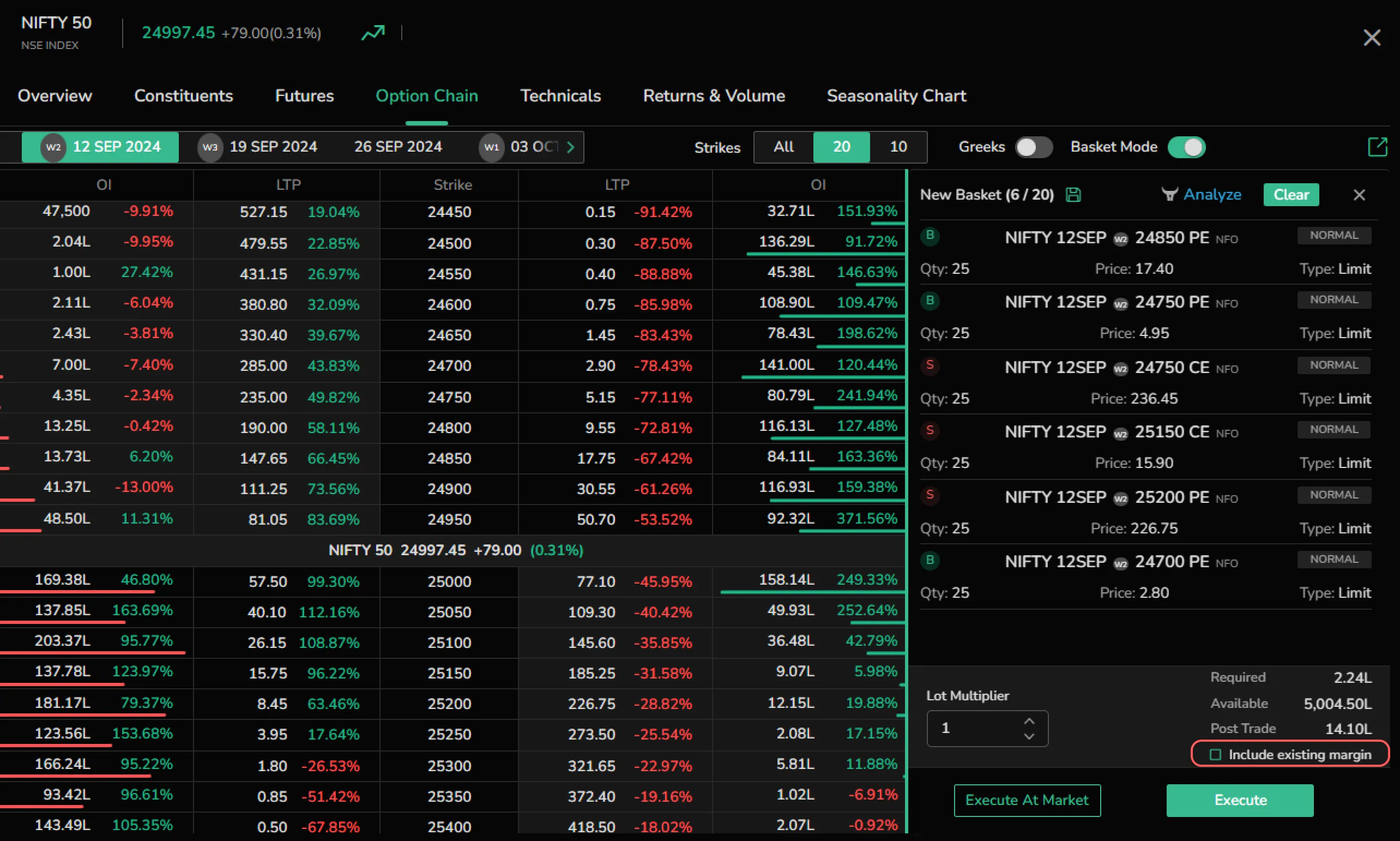

The Option Chain feature is a tabular representation of all the Options Contracts available for a particular symbol or index. The CubePlus Option Chain has the following features:

Expiry Dates: The expiry date, also known as the expiration date, is the last day on which the option can be exercised.

CubePlus offers both weekly and monthly expiries, which can be viewed at the top left corner of the screen. Users can scroll through the available dates and click on the preferred one to view the corresponding contracts.

Strike Prices: The strike price is the predetermined price at which an option holder can buy (in the case of a call option) or sell (in the case of a put option) the underlying asset.

In the CubePlus Option Chain, multiple strike prices are available for each options contract, providing traders with a range of choices based on their market outlook.

Users can choose to view all strikes or limit their view to 10 or 20 strikes closest to the spot price.

Enable Greeks: For more in-depth analysis, users can toggle on the Greeks feature, which provides additional information such as Vega, IV, Delta, Gamma, Theta, and Vwap for each strike.

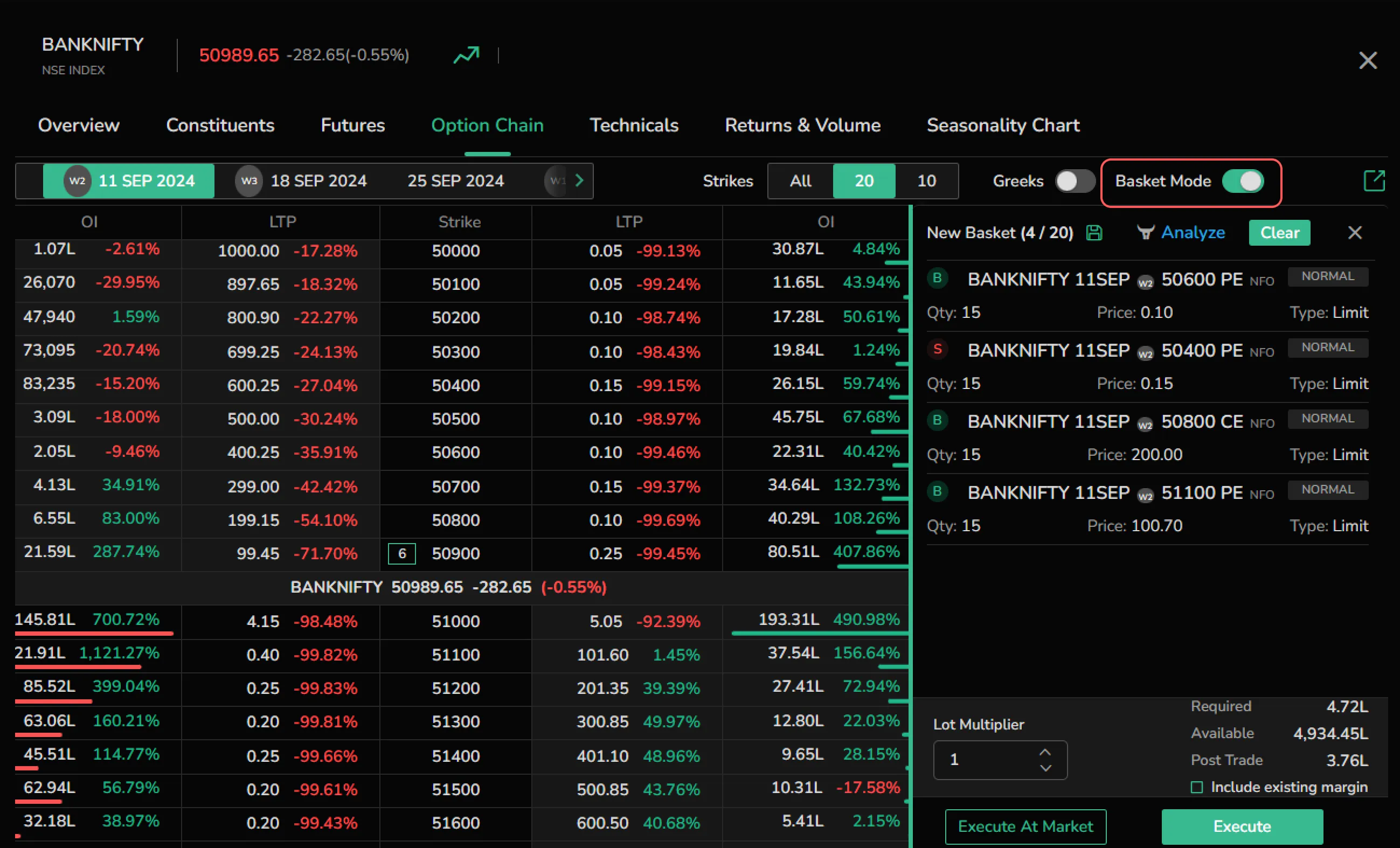

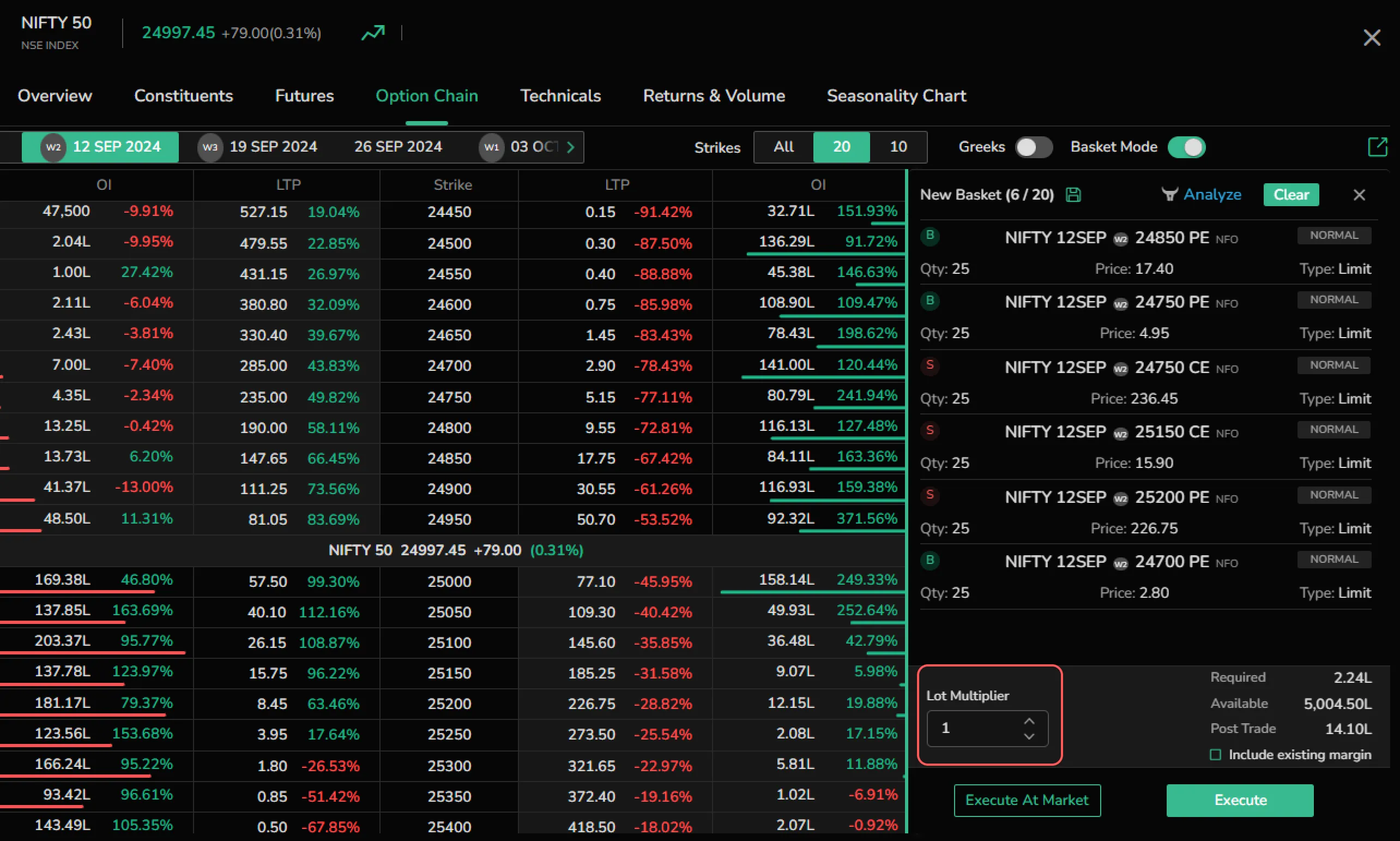

Basket Mode: The Option Chain includes a Basket mode that allows users to add multiple legs to a basket for combined execution. This feature is particularly useful for hedging and executing complex strategies.

Toggle over the Basket to enable it.

The Option Terminal can be accessed by clicking on the ‘window’ icon.

Option Chain Table

The Option Chain table displays the legs with the following particulars:

- Open Interest

- Bid

- Ask

- LTP

- Strike

Spot Price: The spot price represents the current market price at which an asset, such as a commodity, stock, or currency, can be bought or sold for immediate delivery.

In the Option Chain table, the spot price is prominently displayed in the center, with call and put options listed above and below it. The spot price adjusts dynamically with market movements. If users scroll past the spot price, they can click the “Go to Spot” button at the top of the table to return to it.

Open Interest Indicators: The table visually represents open interest through red and green lines on each leg, providing a graphical view of the data.

In the Moneyness Indicators: Contracts that are "in the money" are highlighted in the table with yellow columns in light mode and grey columns in dark or black mode.

Basket in Option Chain

In Basket mode, users can add up to 20 scrips/symbols, enabling them to hedge and execute strategies more effectively.

Here are a few other functionalities of the Basket mode:

- Click on the save icon and type a name to create a basket.

- Tap on ‘Clear’ to remove all added legs from the basket.

- Click on the edit icon in the added legs to modify the order.

- Click on the delete icon in the added legs to delete the order.

Lot Multiplier: To easily adjust quantities, users can utilize the lot multiplier at the bottom of the basket. For example, if the lot size of a call option is 25, and the user sets the lot multiplier to 2, the quantity will automatically increase to 50.

Margin and Funds: The Basket mode also provides important financial details such as the required margin, available funds, and post-trade data. Users have the option to include existing margins by selecting the ‘Include Existing Margin’ checkbox, which allows them to use their current positions for the new trade.

Order Execution: Users can choose to execute the order directly or at market, depending on their trading strategy.

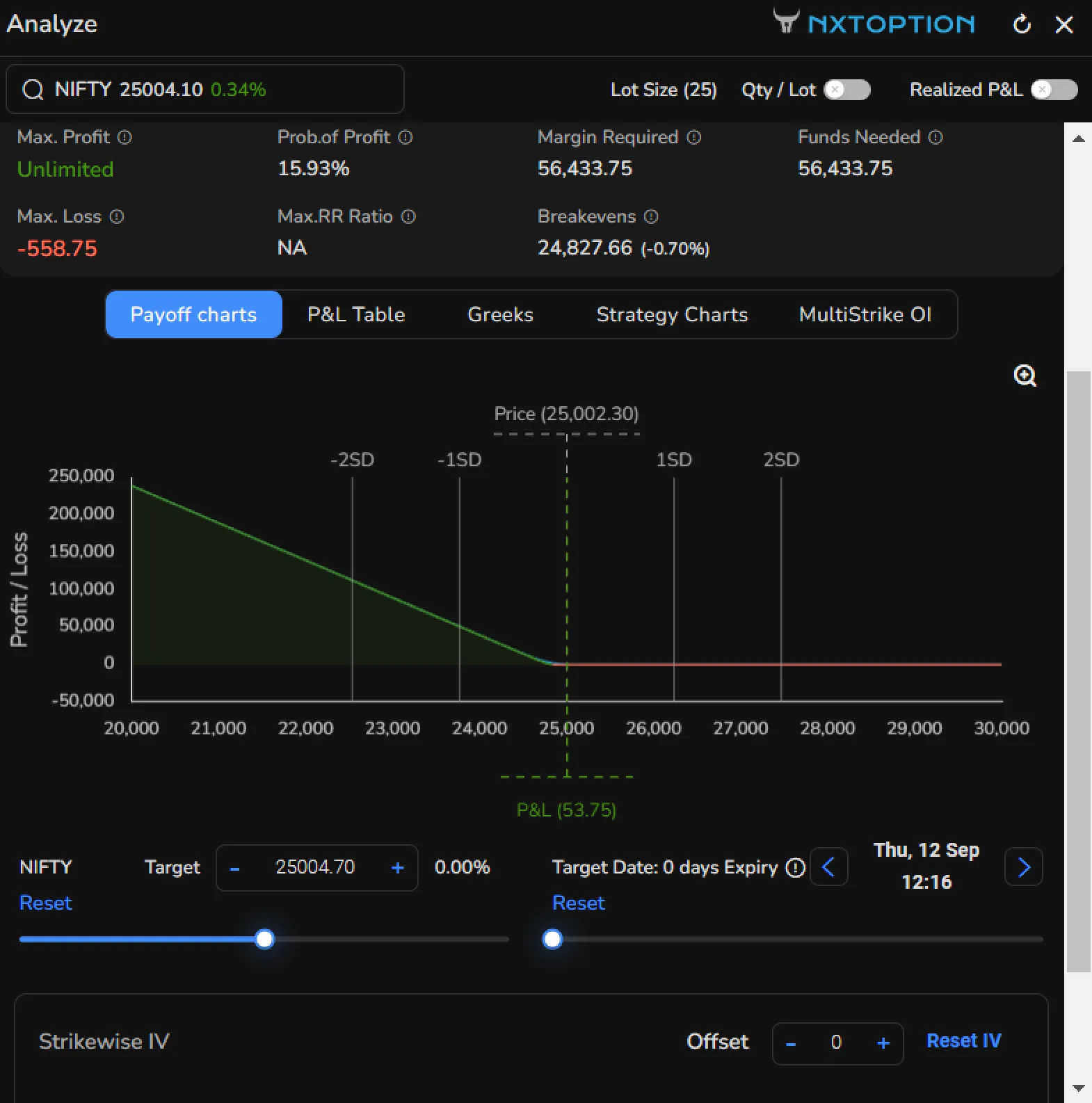

Analyze in Option Chain Basket

Analyze the added legs by clicking on ‘Analyze’ in the Basket. It gives an overview of the below particulars for the selected legs.

- Maximum profit

- Probability of profit

- Margin required

- Funds needed

- Maximum loss

- Maximum RR ratio

- Breakevens

More particulars include:

- Payoff chart

- P&L table

- Greeks

- Strategy charts

- Multistrike OI

Users can modify the expiry date, strike price, option type (CE/PE), quantity, and entry price to observe how these changes impact the contract's performance.

On the Mobile

Click on the stock or indices, then scroll up the ‘Market Depth’ screen and select Option Chain.

The Option Chain on mobile includes all the features available on the web. The Option Chain table provides access to Greeks, Basket, Expiry Date, and Strike Prices.

Strike Price in Mobile

Users can choose to display all strike prices or limit the view to 5 or 20 strikes nearest to the spot price.

Options Table on Mobile

The mobile version of the Options table displays OI, LTP, and Strike Price. Users can click the expand icon on either side to view additional data like volume.

Enable Basket Mode on Mobile

By enabling ‘Basket’ mode, users can tap on the calls and puts legs to add them to the basket for easier trade management.