Order Pad

On the Web

Hover over the instrument on the watchlist and click "Buy" or "Sell" to open the order window. This will bring up an order pad where you can execute the transactions.

- For Equities, choose to trade either from NSE (National Stock Exchange) or BSE (Bombay Stock Exchange).

- When trading derivatives, currency, and commodities, the order pad provides default options to trade on NFO, CDS, and MCX respectively.

Order Pad

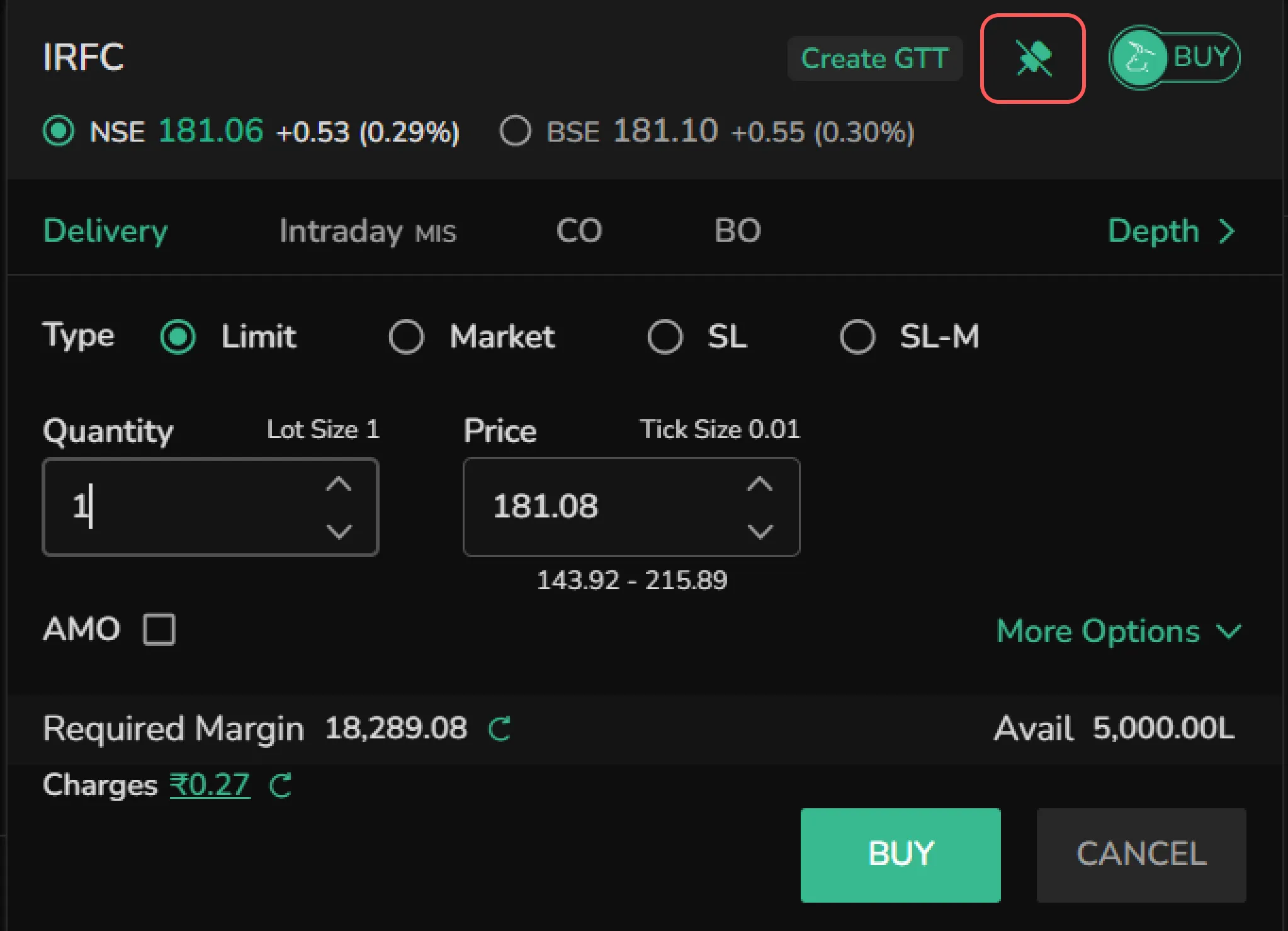

The symbol name appears on the top along with create GTT, Pin option, and a toggle button to switch between buy and sell.

Sticky Window: Pin the Order Pad to place multiple orders. To remove the order window, simply unpin and buy/sell or cancel the order.

Floating Window: Click and drag the order window to adjust its position as needed.

Product Types

- Delivery Order

- Intraday Order

- Cover Order

- Bracket Order

Order Types

CubePlus supports four types of orders namely:

- Limit Order

- Market Order

- Stoploss Order

- Stoploss-Market Order

Delivery Order

Also known as CNC (Cash and Carry), Delivery trading involves buying shares and taking delivery or selling shares and giving delivery.

Executed orders appear in positions on the same day and holdings from the next day. This can be sold at any point of time after purchase as the user wishes.

To buy shares for delivery, user must have 100% of the funds, as no additional margin or leverage is available. To sell shares using delivery, the shares must already be in users’ holdings.

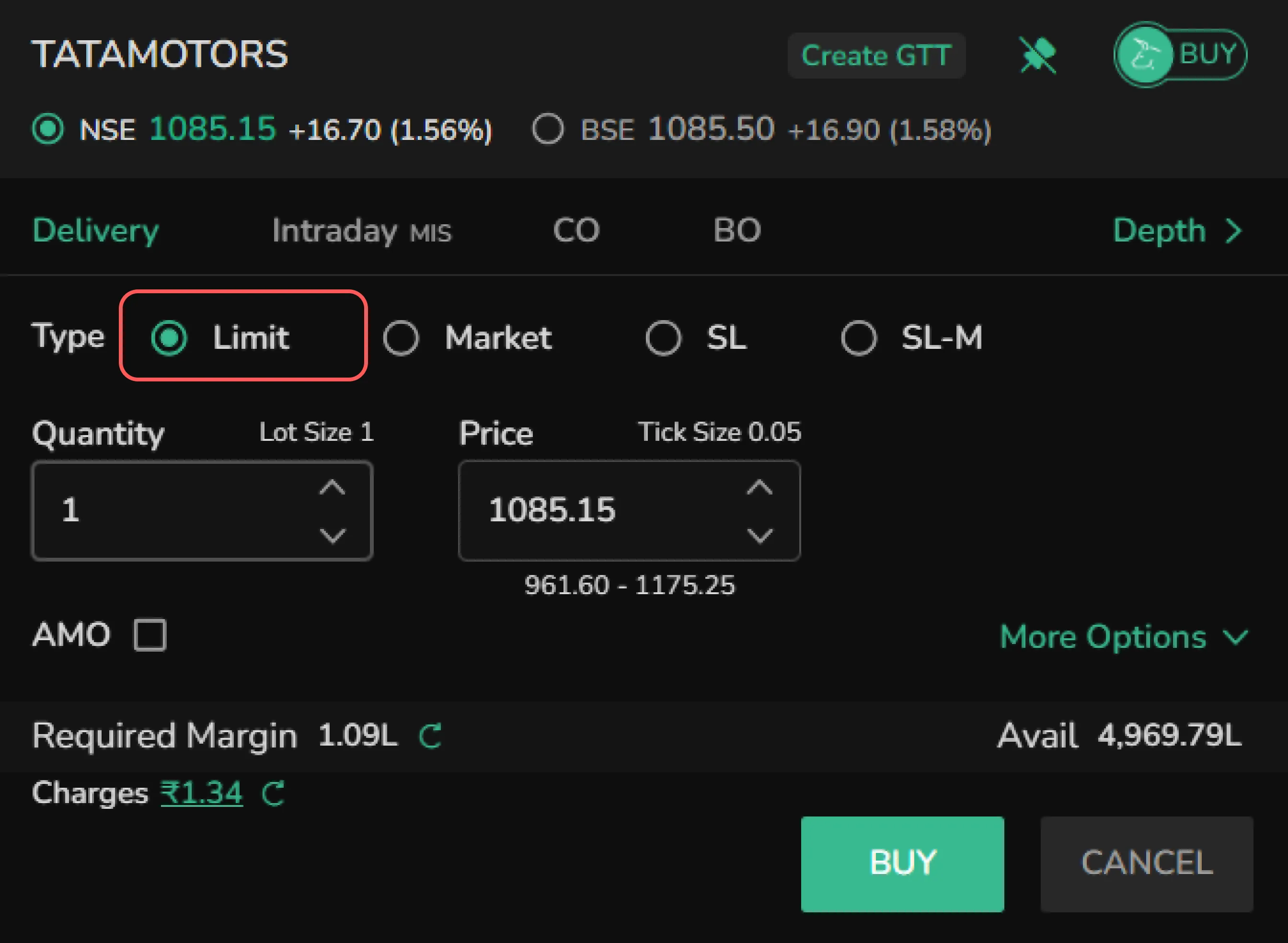

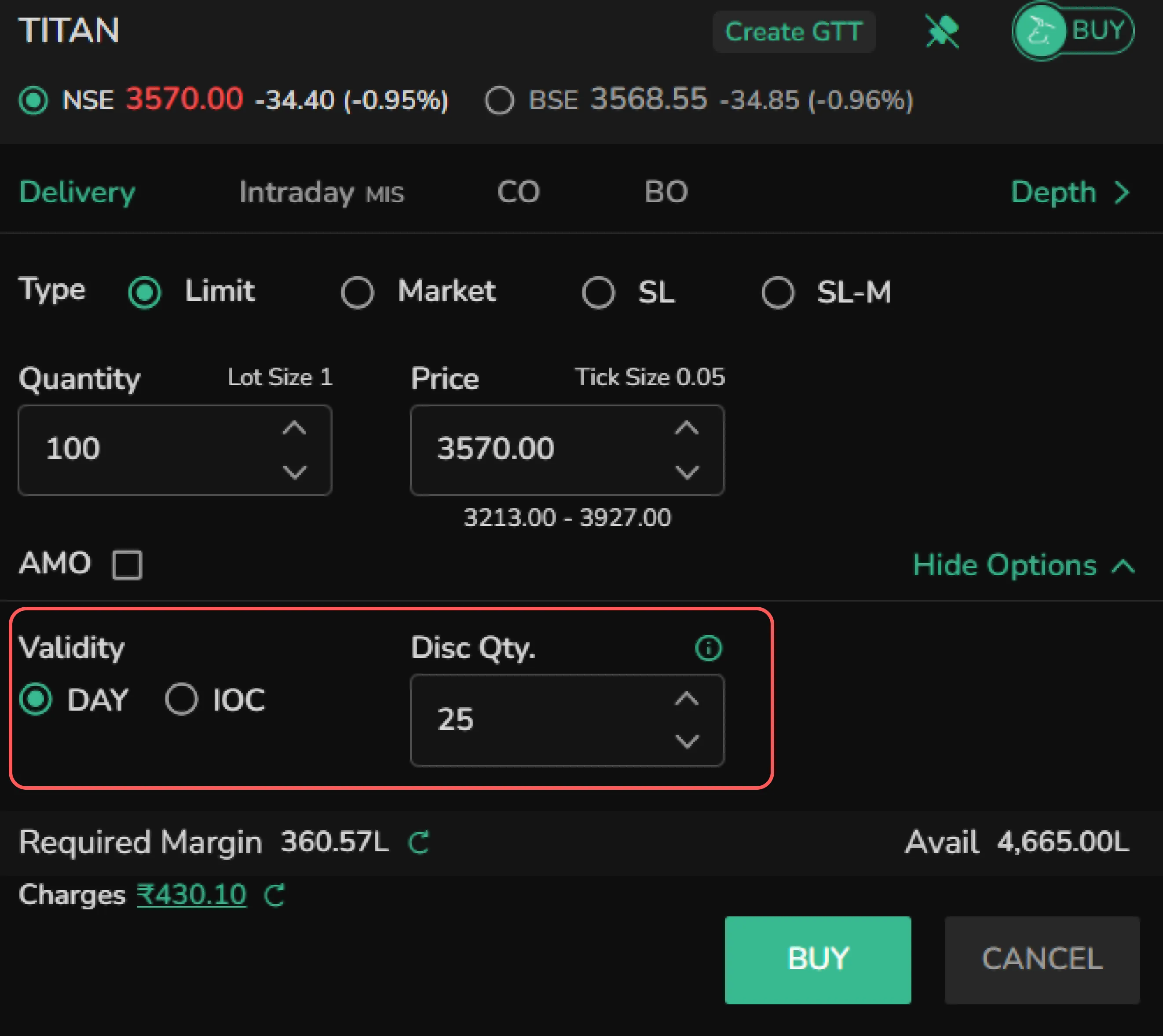

Limit Order

Limit order allows users to buy or sell a stock at a specified price. When a Buy limit order is placed, it will only be executed at or below the specified price. Conversely, a Sell limit order will be executed at or above the predetermined price. A Buy limit order ensures the purchase at the limit price or lower, while a Sell limit order ensures the sale at the limit price or higher.

Quantity and Price: Enter the desired quantity and price. Ensure the price is within the indicated range.

Tick Size: Indicated above the price box, specifying the increments for the price.

AMO (After Market Order)

AMO can be placed only after market hours. Check the AMO box to place the order, which will remain pending until the next trading day when it will execute if the price matches.

Additional Options

- Validity: Choose between "DAY" (order cancels if not executed by market close) or "IOC" (Immediate or Cancel; order cancels immediately if not executed).

- Disclosed Quantity (Disc Qty): Only part of the order quantity is disclosed to the market, subject to the minimum disclosure of 10% of the total order quantity.

Following are the remaining elements of the Order Pad

- Avail- Shows the available balance in Funds

- Required margin- This displays the margin required to execute the trade

- Charges- Displays the charges involved in the transaction.

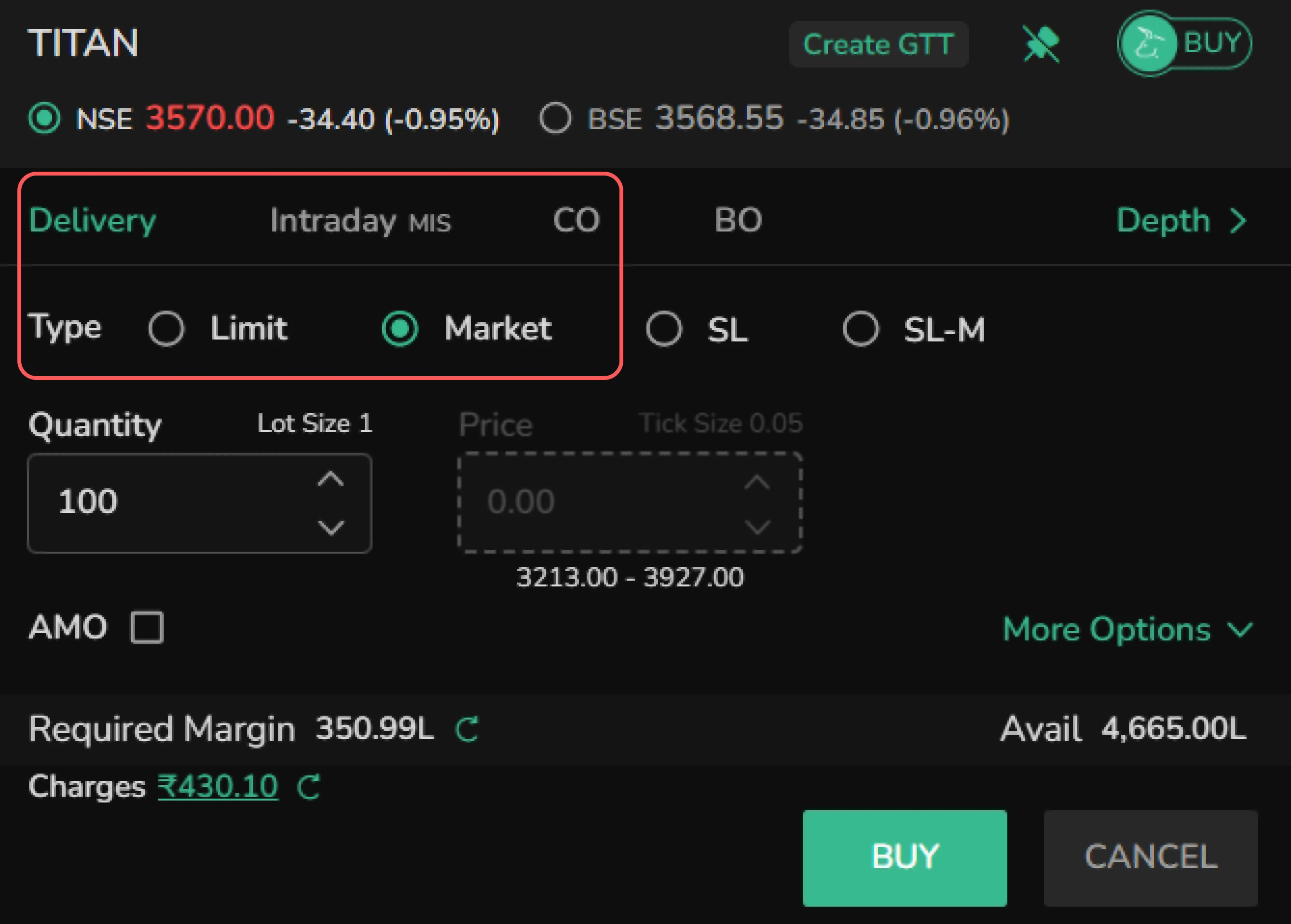

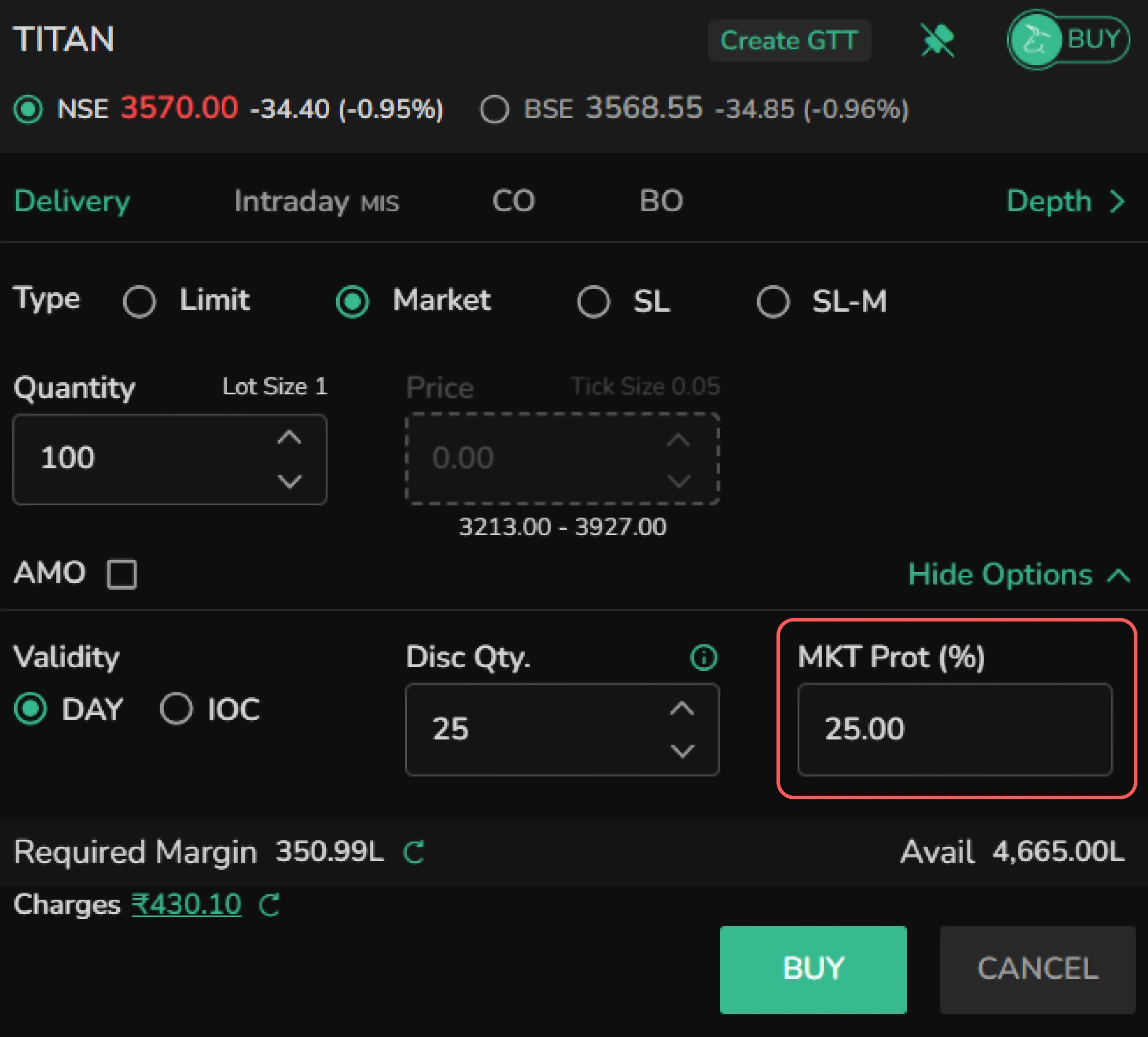

Market Order

A market order is a type of order to buy or sell a security immediately at the current market price. It ensures quick execution but does not guarantee the price at which the order will be filled.

- Users need to enter the quantity.

- Entering MKT Prot % will safeguard against potential losses. For example If 5% MKT Prot is entered and a sell market order when the last traded price is Rs.200, is placed will convert your order into a limit order at Rs.190, ensuring that your order won't be executed below Rs.190, regardless of market fluctuations.3. Check the required margin and charges, and execute the order.

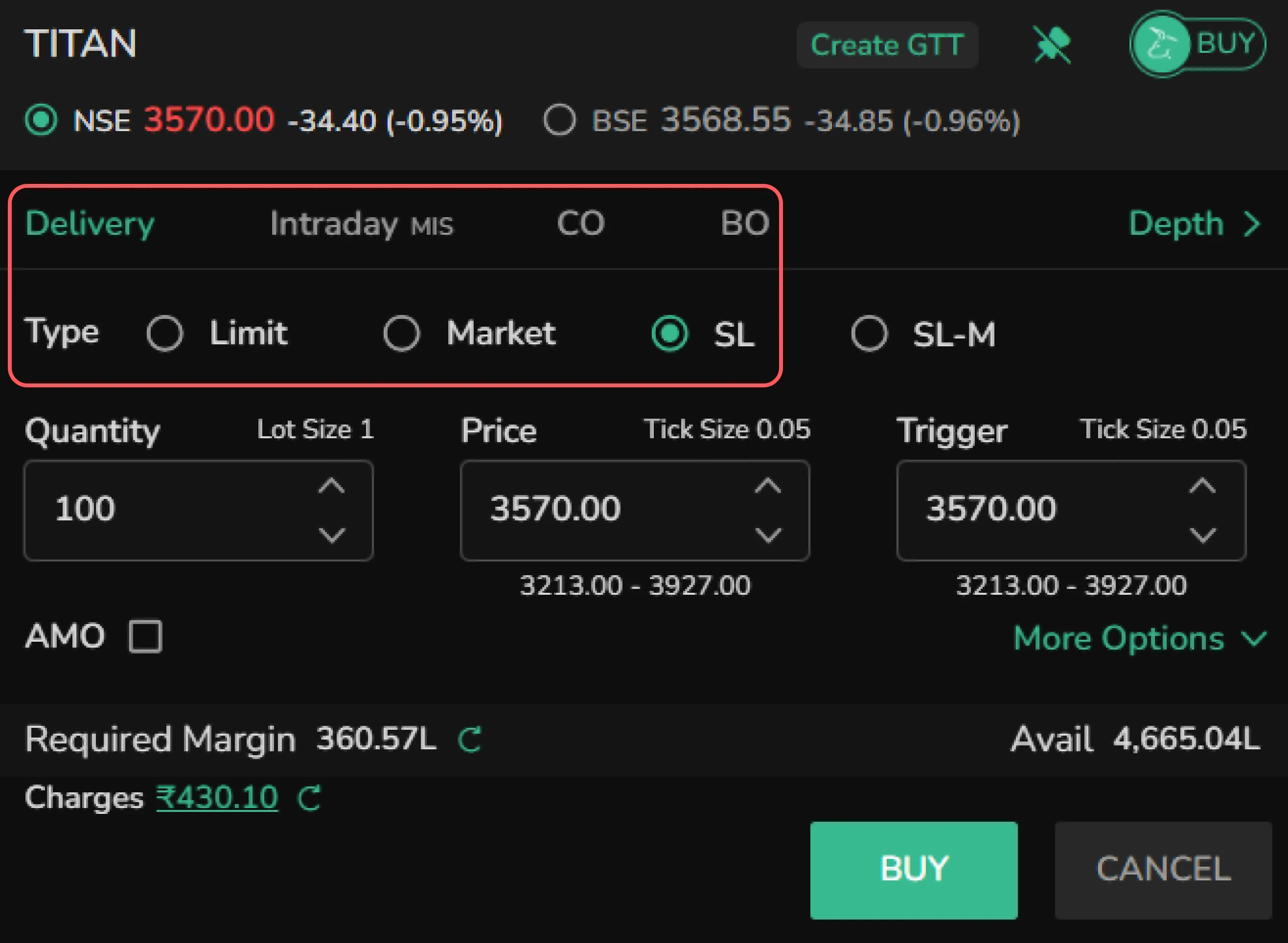

Stoploss (SL) Order

Use stoploss order to buy or sell a security once it reaches a specified price. It is designed to limit an investor's potential loss on a position by triggering a sale or purchase when the market moves unfavorably.

- Enter the quantity, price, and trigger price.

- In validity, only ‘DAY’ option is available in SL.

- Enter the disclosed quantity and execute the order.

When the Last Traded Price (LTP) reaches or breaches the trigger price, the order gets triggered, converting to limit order.

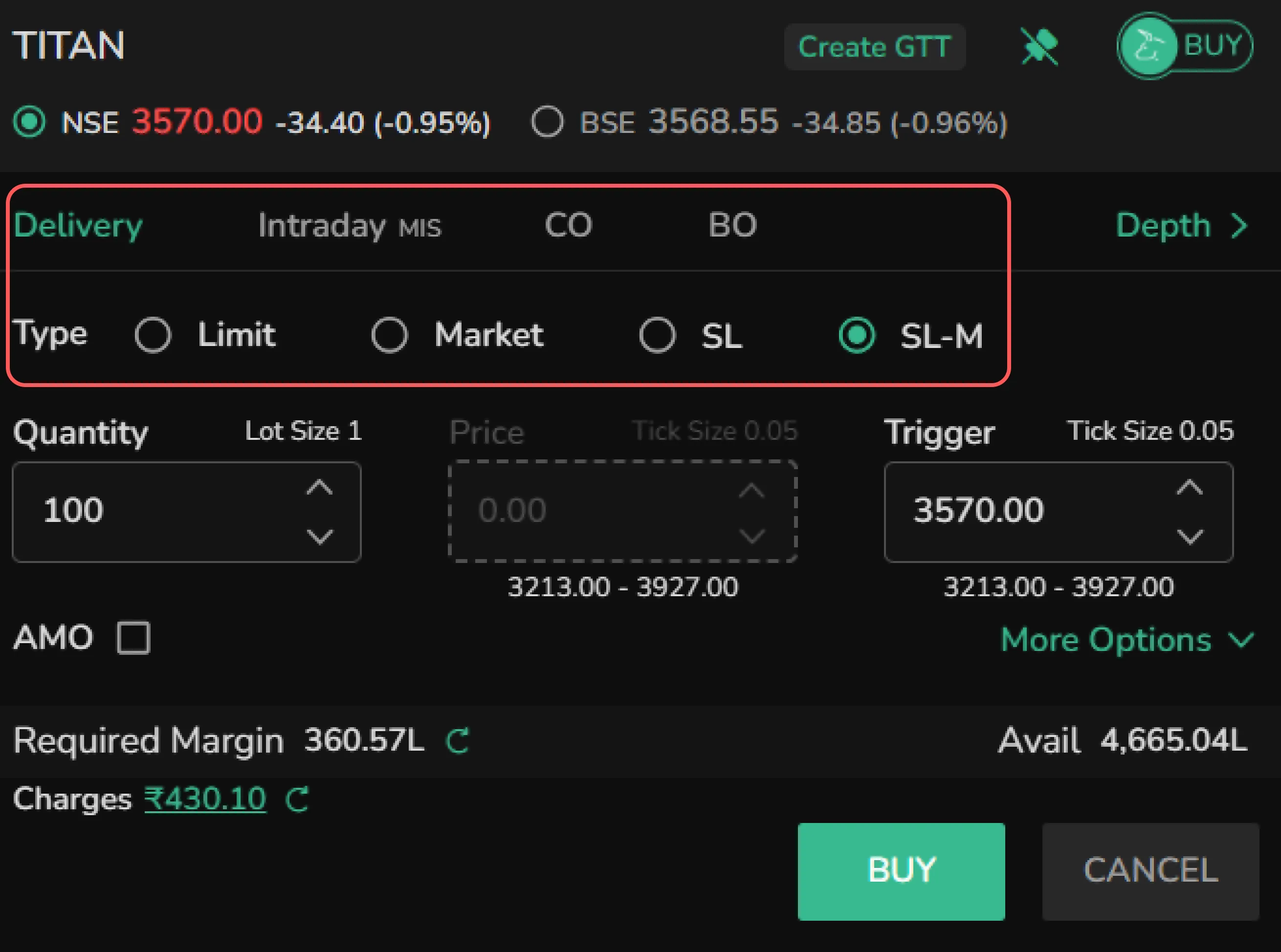

Stoploss-Market (SL-M) Order

A stoploss market order is an order to buy or sell a security at the market price once it reaches a specified stop price, ensuring execution but not the exact price.

- Enter quantity and trigger price.

- In validity, only ‘DAY’ option is available in SL.

- Enter the disclosed quantity and MKT prot, and execute the order.

Intraday Order

Also known as Margin Intraday Square Off (MIS), Intraday order allows traders to take higher intraday trading positions using available cash and stock holdings as margin. These positions must be closed before the market closes on the same trading day.

Enhanced Leverage: MIS offers additional leverage or margin for intraday trades in equity segment.

Auto Square-Off: MIS positions are automatically squared off 15 minutes before market closure.

RMS Initiated Square-off: RMS will initiate square-off when MTM losses exceed 70% of the available margin.

Margin Requirements:

- For equity intraday trades, a minimum margin of 20% of the trade value is required, offering upto 5X leverage.

- For F&O trades, 100% of the NRML margin is required.

The execution process for intraday trading is quite similar to delivery trading, with the key difference being that all transactions are completed within the same trading day.

Cover Order

Cover order is a special type of order that combines a market or limit order with a mandatory stop-loss order. This combination allows traders to take advantage of higher leverage while minimizing risk.

The stop-loss order is set at a lower price for buying and a higher price for selling. Cover orders can be placed for both long and short trades, providing added protection and flexibility.

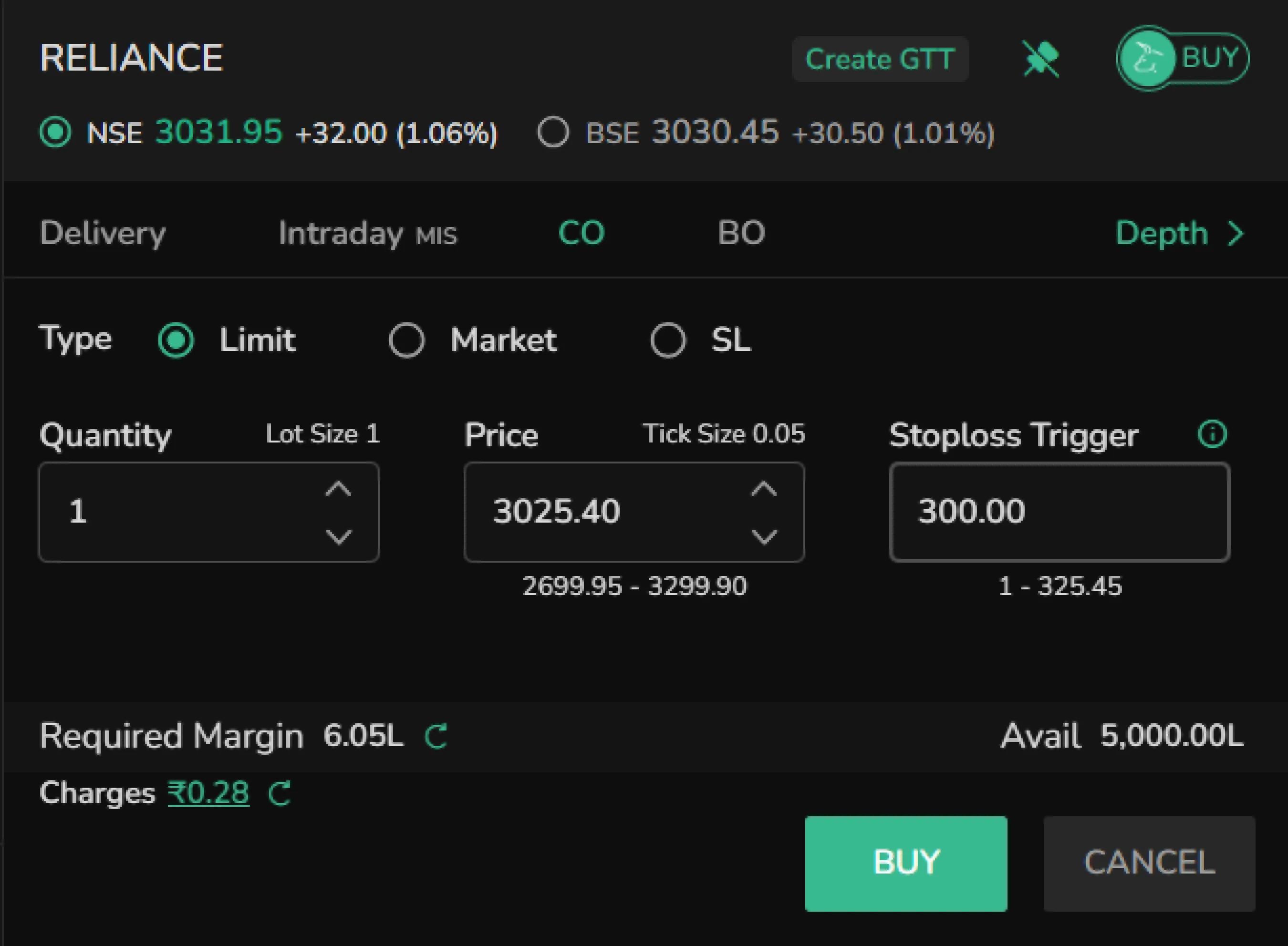

Cover- Limit Order

Enter a cover order position for Reliance by selecting the CO order type as Limit. In this example (Reliance buy CO with a limit of 2900 and 100 as diffrence b/n 1st leg execution price and stoploss trigger), Reliance would be bought at ₹2900 (the current market price is ₹2941). The order will remain open until the stock reaches ₹2900, at which point it will execute to initiate the position. The stop-loss trigger price is set at ₹2800, meaning the stop-loss order will be placed as soon as the 1st leg entry order is executed at ₹2900.

- After the first leg of a Cover Order (CO) is executed, the second leg cannot be canceled.

- To close the CO position, it must be done through the open orders section by selecting "exit" on the second leg, rather than from the positions tab.

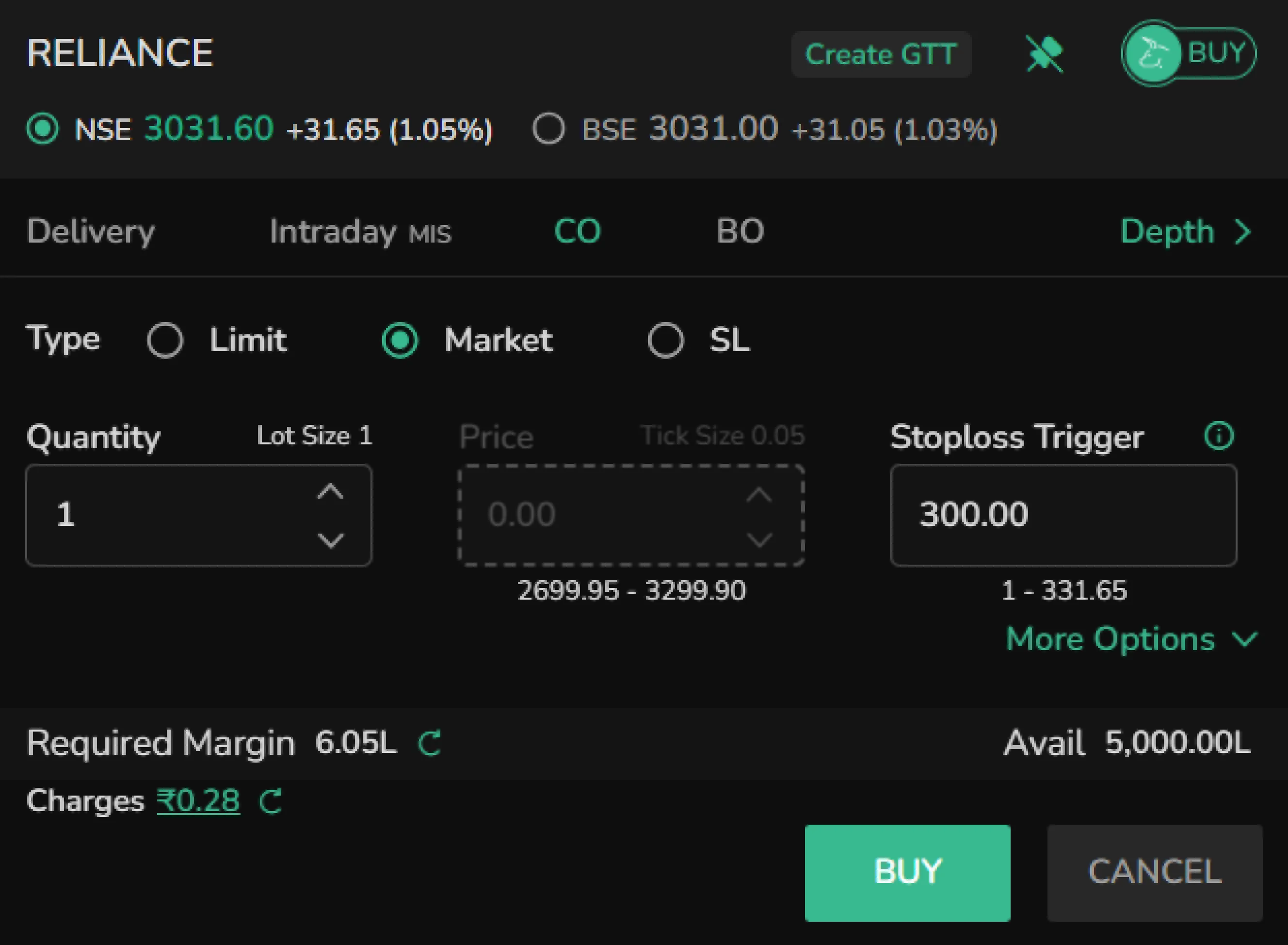

Cover- Market Order

Enter a cover order position for Reliance by selecting the CO order type as market. In this example (Reliance buy CO with market and 100 as diffrence b/n 1st leg execution price and stoploss trigger), Reliance would be bought at ₹2941 (i.e. the current market price). Once the order is executed, a stop-loss trigger is set at ₹2841, ensuring that the stop-loss order is placed immediately after the market order is executed.

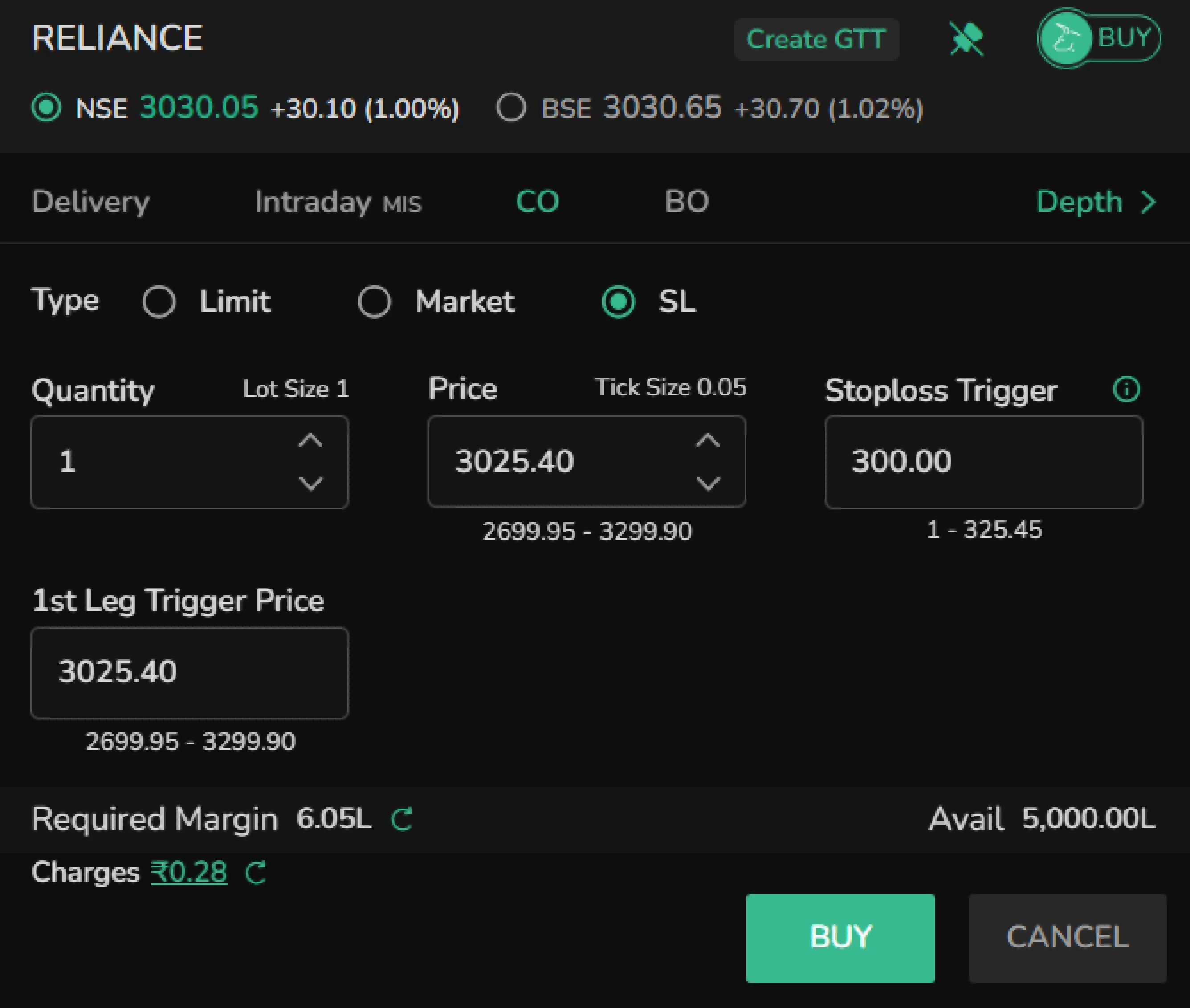

Cover- SL Order

In this case the 1st leg of the order will be executed only after stoploss trigger. After the execution of the 1st leg order, the 2nd leg stoploss order will be auto placed.

Bracket Order

A bracket order is a combination of a three orders. 1st leg entry order with both a stop-loss and a target order. This type of order helps traders manage risk and lock in profits by automatically setting both protective stop-loss and profit-taking levels.

It involves placing an initial order along with two opposite orders (stop-loss and target) to manage trades effectively and ensure positions are squared off by the end of the trading session.

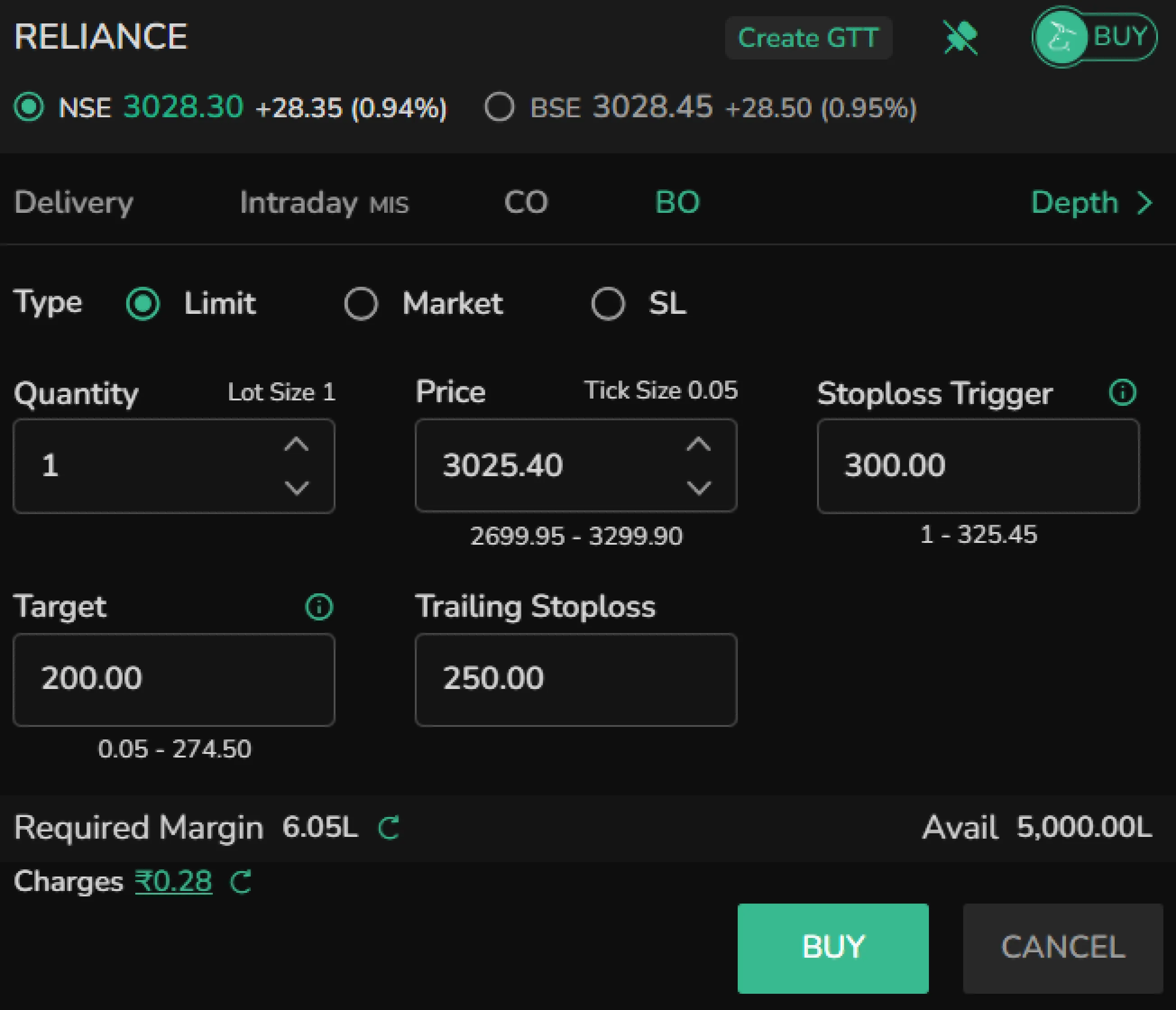

Bracket- Limit Order

Place a bracket order for Reliance at a Limit price of 2900 (CMP 2941) with a target of 200 and Stoploss of 100. The order will get executed only when the market price falls to 2900. If the order executes at 2900, Simultaneously, the system will set a stop-loss order at ₹2800 to limit potential losses and a target price at ₹3100 to secure profits. This setup ensures automatic management of the trade throughout the day.

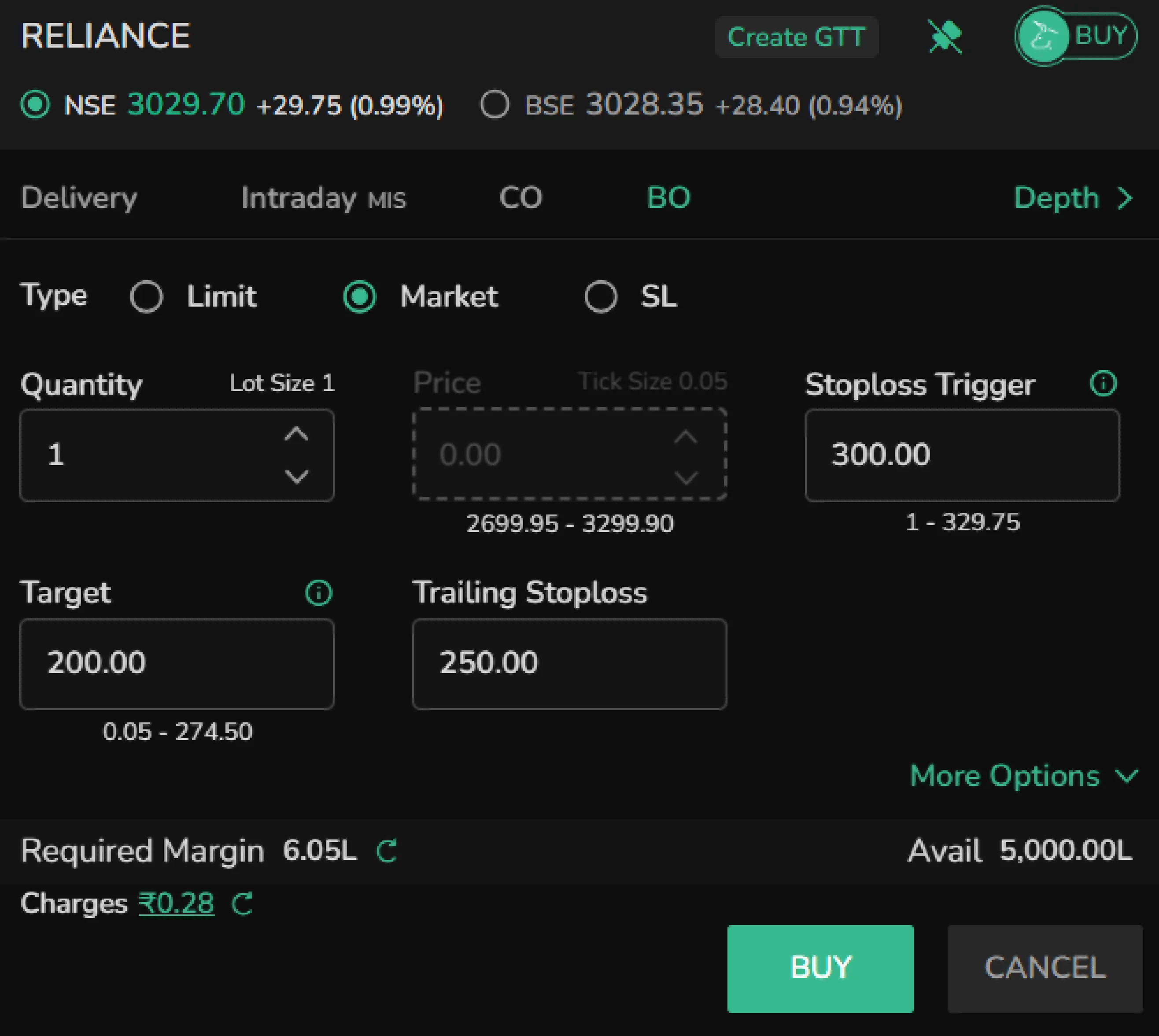

Bracket- Market Order

Place a bracket order for Reliance by selecting the Bracket Order (BO) type as Market with a target of 200 and stoploss of 100. In this example, Reliance will be bought at the current market price of ₹2941 Upon execution of the market order, a stop-loss will be placed with 2841 as trigger and a target order will be placed with a limit price at ₹3141. This ensures the stop-loss order is placed immediately to limit losses, and the target order is set to secure profits.

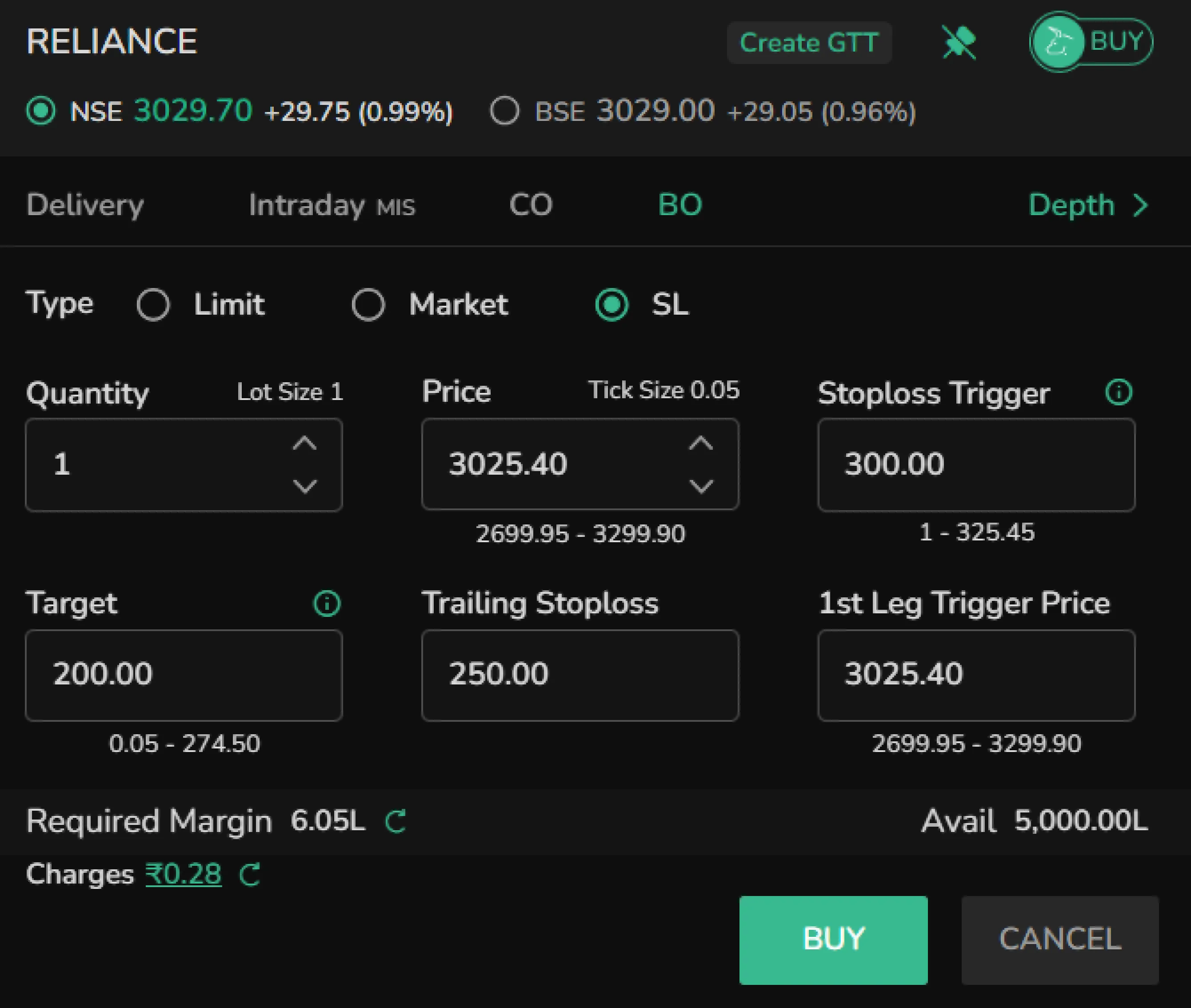

Bracket- Stoploss Order

In this case 1st leg of the Bracket order will be executed only after stoploss trigger. After the execution of the 1st leg order, the stoploss order and target order will be auto placed.

On the Mobile

Access the order pad from the Quote Overview page on mobile. Click on Buy or Sell to go to the order pad.

If the UI transition is enabled in the mobile account settings, users can ‘Swipe to Buy or Sell’.

Enable preview screen in the settings to view order summary before executing the order.