Positions

Positions refer to the current holdings of a security or asset. They reflect an investor's exposure to a specific market and are used to track performance, monitor potential gains or losses, and effectively manage investment strategies.

On the Web

In the Positions tab, users can place orders. Equity orders appear in positions after execution and are moved to holdings the next day. Derivative, currency, and commodity orders remain in positions until expiry.

Access Positions

Click on Positions in the menu bar to navigate to the positions tab.

Positions List

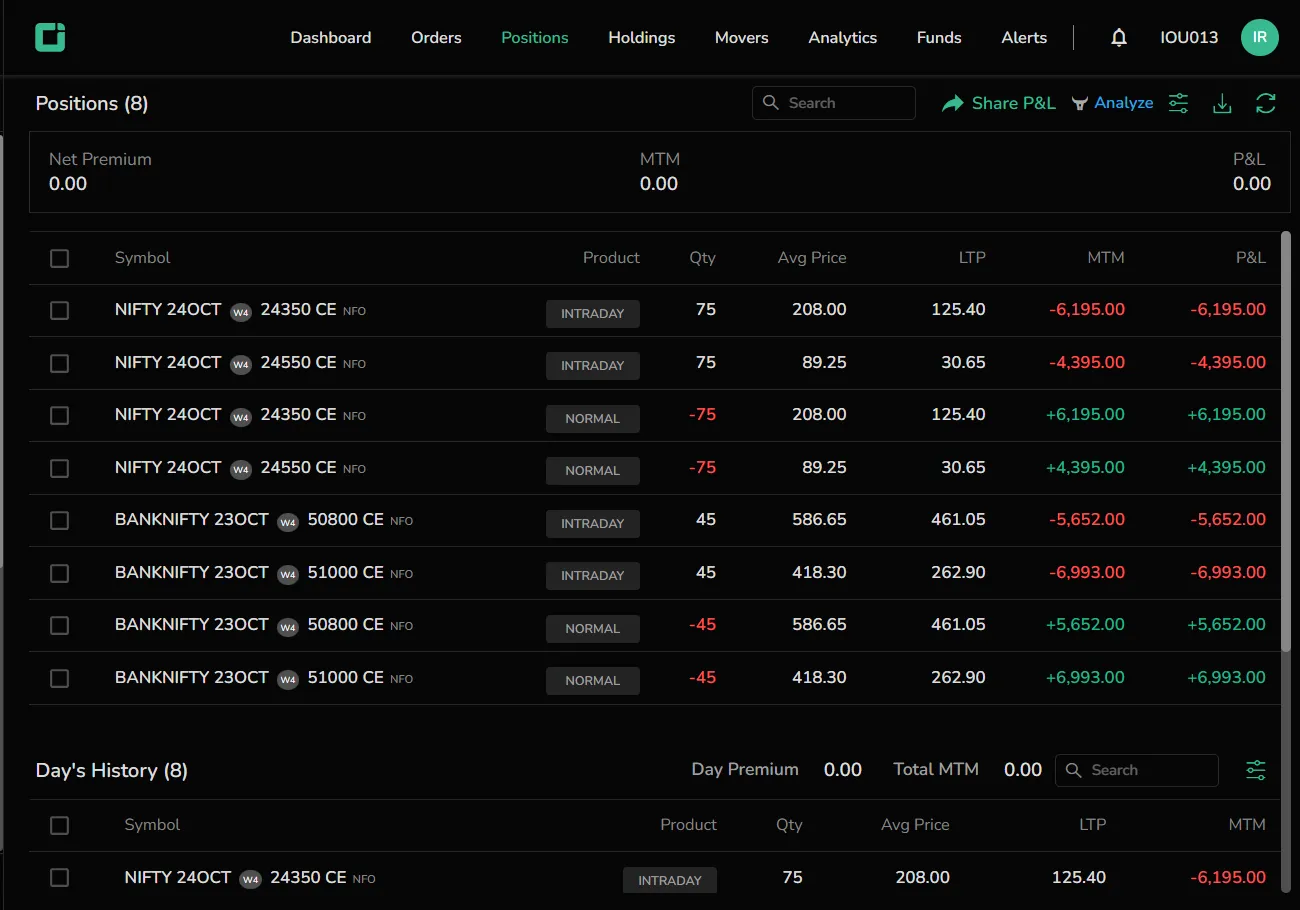

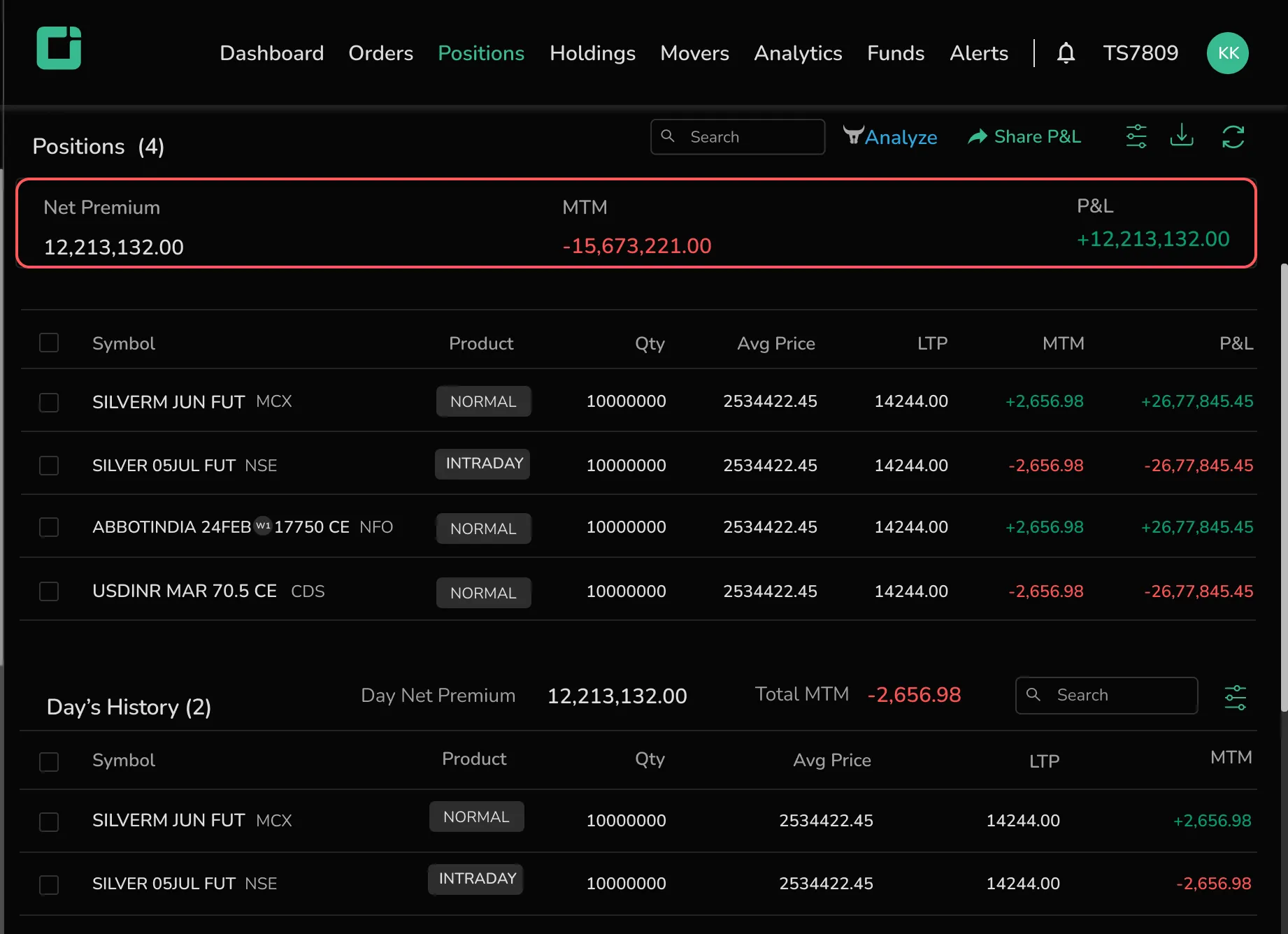

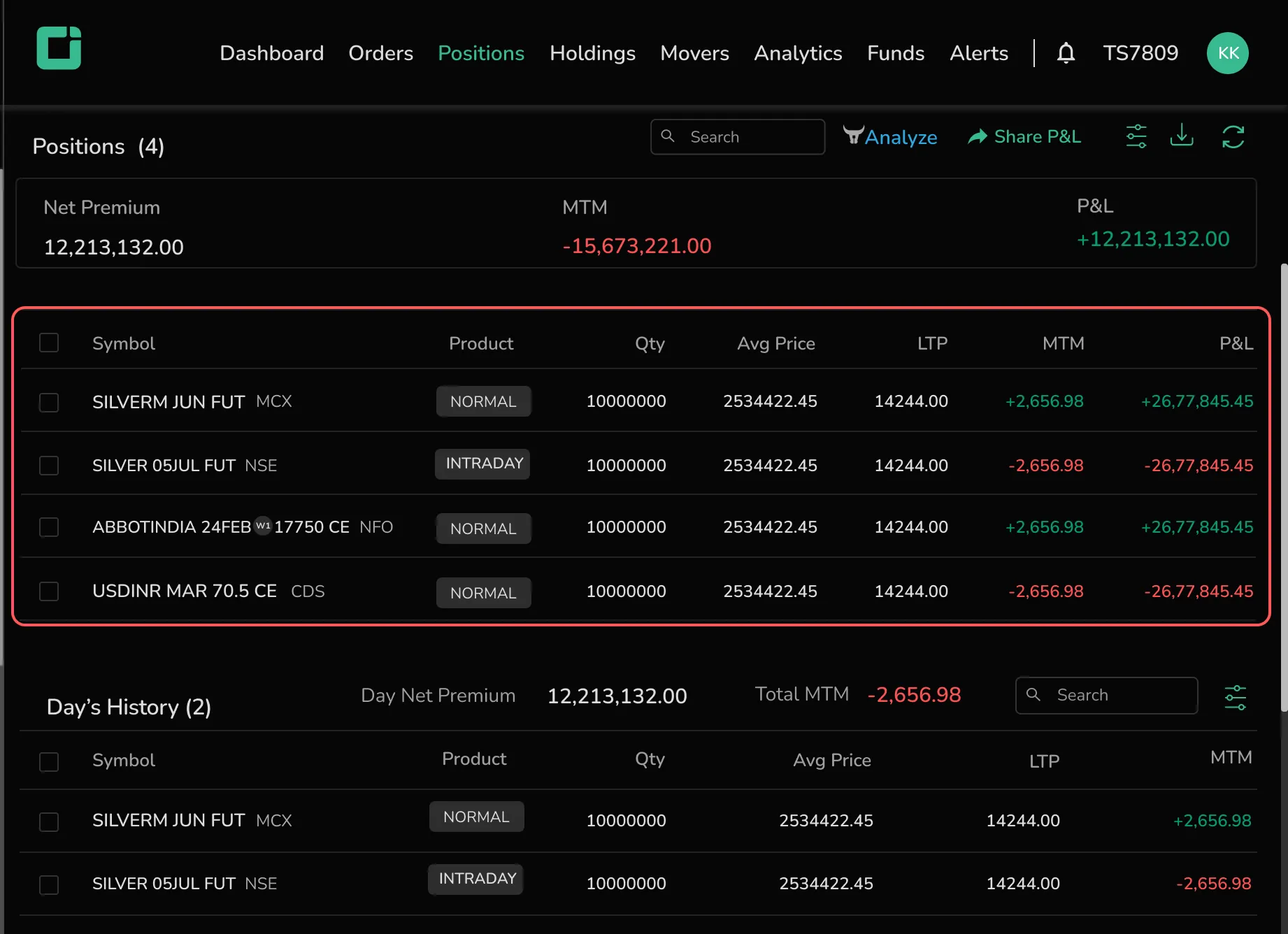

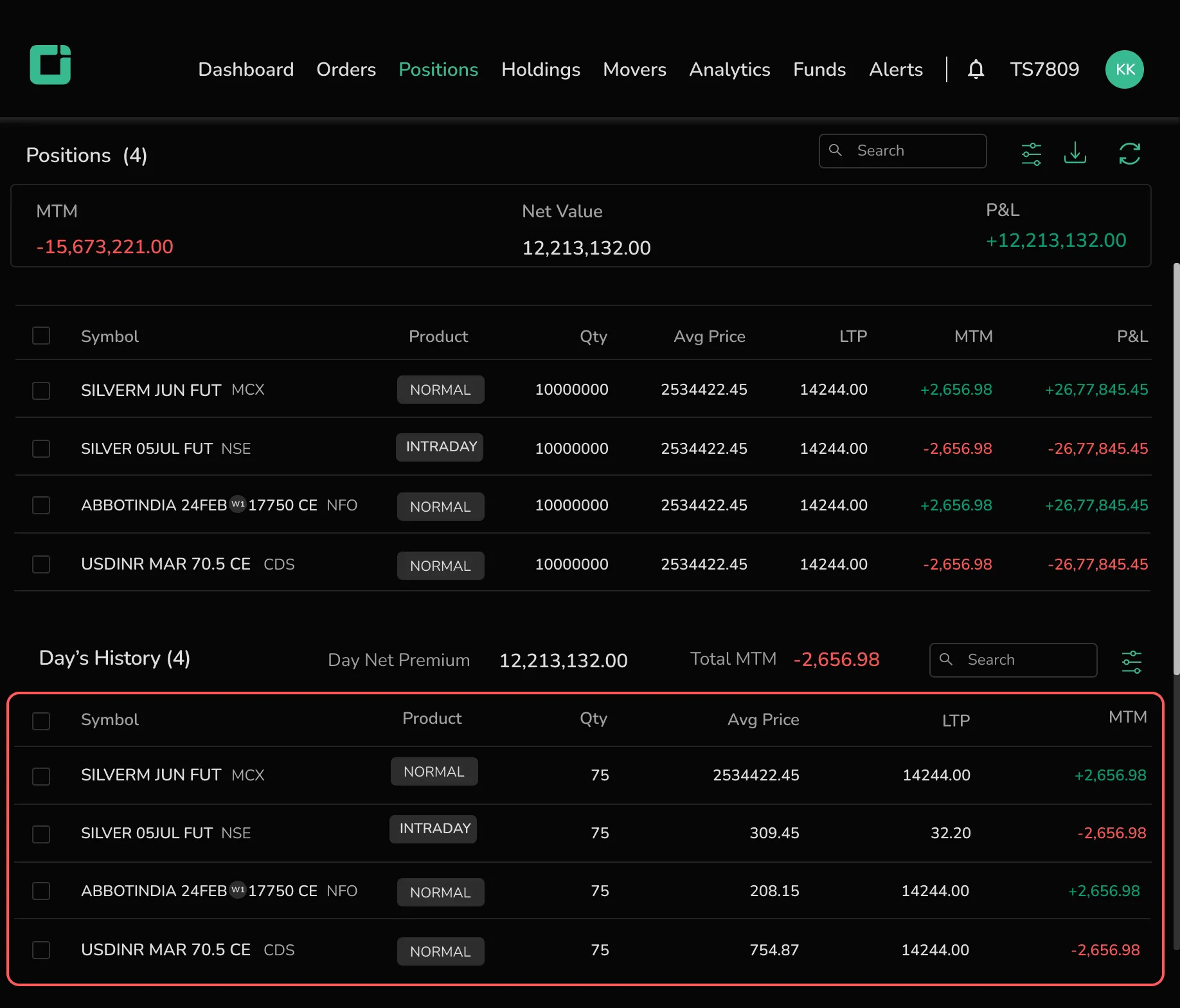

At the top of the positions list, users can find the following details:

- Net premium: The total amount paid or received for an options position, calculated as the difference between premiums for all bought and sold options.

- MTM (Mark-to-Market): Reflects the daily adjustment of an asset’s value to its current market price, showing unrealized gains or losses on a position.

- P&L (Profit and Loss): Shows the financial outcome of a trade or investment, indicating the difference between the cost and current value, reflecting either a gain (profit) or a loss.

Positions Table

The positions table provides the following details for each symbol:

- Symbol name

- Product

- Quantity

- Average price

- LTP (Last Traded Price)

- MTM

- P&L

Day History

Below the general positions table, users can find the Day’s History, which lists the day’s orders along with the day’s premium and total MTM. Similar details are also available for each symbol in this section.

Share P&L

To share the profit and loss on social media, click on the Share P&L icon. A pop-up will appear with a Public P&L link. Options to share it directly on platforms like Facebook, Twitter, WhatsApp, Telegram, and Instagram are also available.

Other Features

- Search for a particular symbol.

- Use customized filters for easier viewing.

- Click on Download to export the positions data.

- Refresh the page as needed.

Trailing Stoploss Order

A Trailing Stop Loss is a flexible stop order that adjusts automatically with a security's price movement. When the price moves favorably, the trailing stop "trails" at a specified distance, helping investors lock in gains or limit losses without manual adjustments. If the price reverses, the stop level remains fixed, securing profits or minimizing losses.

Short Scenario: Suppose an investor shorts a stock at Rs.100 and places a buy trailing stoploss order with a trailing price set to 5 and trigger price set to 105 . If the stock price drops to Rs.90 from 100, the trailing stop trails to Rs.95 from 105. If the stock rises to Rs.95, the position closes, limiting potential losses. If the price keeps dropping, the trailing stop adjusts to secure more gains.

Long Scenario: In a long position, if an investor buys a stock at Rs.100 and places a sell trailing SL order with a trailing price set to 5 and trigger price 95, and if the price rises to Rs.110, the stop loss trails to Rs.105. If the stock price falls to Rs.105, the position closes, locking in some gains. However, if the price continues upward, the trailing stop follows, protecting additional gains as the stock climbs.

Creating a Trailing Stop Loss Order

- In the "Positions" tab, select "More" and click "Create TSL."

- An order pad opens in the opposite action of the existing position (e.g., a buy position opens a sell TSL order).

- The order type defaults to "stop loss".

For a buy order, the TSL order pad shows the sell option, while for a sell order, the TSL order pad shows the buy option. Similar to a regular stop loss, users can enter Quantity, Price, and Trigger Price. Additionally, for TSL, users need to specify the Trailing Price and Target.

Once the order is active, the trailing stop follows the stock price: for a buy order, it moves up as the price rises; for a sell order, it moves down as the price drops. If the stock reverses after reaching a peak or low, the stop triggers at that point, executing the order to secure gains or minimize losses.

TSL is only available for three segments:

- NSE

- NFO

- CDS

On the Mobile

Click on Portfolio in the menu bar and navigate to Positions.

The NET positions appear by default in the Positions tab. Toggle between P&L and MTM to view the profit and loss or mark-to-market scenario of the symbols.

Position Filters

In addition to customized filters, the mobile version provides sorting options such as:

- Alphabetically

- Last Traded Price

- Profit & Loss

- MTM

- Click on Clear to reset all filters.

To change the view from NET to DAY positions, click on the floating Position Type option below and switch to DAY.